Profitability ratios

Profitability ratios measure the company's use of its assets and control of its expenses to generate an acceptable rate of return-

- Gross margin, Gross profit margin or Gross Profit Rate[7][8]

-

- OR

-

- Operating margin, Operating Income Margin, Operating profit margin or Return on sales (ROS)[8][9]

-

- Note: Operating income is the difference between operating revenues and operating expenses, but it is also sometimes used as a synonym for EBIT and operating profit.[10] This is true if the firm has no non-operating income. (Earnings before interest and taxes / Sales[11][12])

-

- Profit margin, net margin or net profit margin[13]

-

-

- Return on equity (ROE)[13]

-

-

- Return on investment (ROI ratio or Du Pont Ratio)[6]

-

-

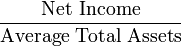

- Return on assets (ROA)[14]

-

-

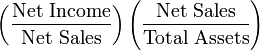

- Return on assets Du Pont (ROA Du Pont)[15]

-

-

- Return on Equity Du Pont (ROE Du Pont)

-

-

- Return on net assets (RONA)

-

-

- Return on capital (ROC)

-

-

- Risk adjusted return on capital (RAROC)

-

- OR

-

- Return on capital employed (ROCE)

-

- Note: this is somewhat similar to (ROI), which calculates Net Income per Owner's Equity

-

- Cash flow return on investment (CFROI)

-

[edit] Liquidity ratios

Liquidity ratios measure the availability of cash to pay debt.-

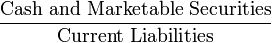

- Operation cash flow ratio

-

[edit] Activity ratios (Efficiency Ratios)

Activity ratios measure the effectiveness of the firms use of resources.-

- Stock turnover ratio[20][21]

-

-

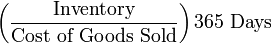

- Inventory conversion ratio[4]

-

-

- Inventory conversion period (essentially same thing as above)

-

-

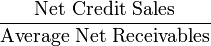

- Receivables conversion period

-

-

- Payables conversion period

-

- Cash Conversion Cycle

-

- Inventory Conversion Period + Receivables Conversion Period - Payables Conversion Period

[edit] Debt ratios (leveraging ratios)

Debt ratios measure the firm's ability to repay long-term debt. Debt ratios measure financial leverage.-

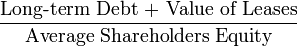

- Long-term Debt to equity (LT Debt to Equity)[24]

-

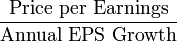

[edit] Market ratios

Market ratios measure investor response to owning a company's stock and also the cost of issuing stock. These are concerned with the return on investment for shareholders, and with the relationship between return and the value of an investment in company’s shares.-

- Earnings per share (EPS)[25]

-

-

- Dividend cover (the inverse of Payout Ratio)

-

-

- Cash flow ratio or Price/cash flow ratio[27]

-

-

- Price to book value ratio (P/B or PBV)[27]

-

Sector-specific ratios

[edit] Capital Budgeting Ratios

Main article: Capital budgeting

In addition to assisting management and owners in diagnosing the financial health of their company, ratios can also help managers make decisions about investments or projects that the company is considering to take, such as acquisitions, or expansion.Many formal methods are used in capital budgeting, including the techniques such as

Good job!!! :-)

ReplyDeleteKeep it up.

You are interested in accounting and I am in Biology and Social works....